Capitalism isn't simply "markets and trade"

What exactly is capitalism and why does it matter?

What is capitalism?

There’s a lot of talk about the role capitalism plays in our ecological crises, and how we can transition to a new, less harmful system. Because of this, I think it’s important to ensure that capitalism is properly defined, so that we know exactly what we are looking to transition away from and therefore can do so most effectively. When I talk about capitalism I am using this (long, but important) definition by economic anthropologist, Jason Hickel:

People often assume that capitalism is defined by "markets and trade". But markets and trade existed for thousands of years before capitalism. Capitalism is only 500 years old. So what is distinctive about this economic system? Three things … :

1. First, and most importantly, it is defined by enclosure and artificial scarcity. The origins of capitalism lie in a systematic effort by elites to restrict people's access to commons and independent subsistence, in order to render them reliant on wage labour for survival….

2. Second, capitalism is organized around - and dependent on - perpetual expansion, meaning ever-increasing production of commodified goods. It is the only intrinsically expansionary economic system in history (meaning it basically has a crisis if it doesn't continually expand).

Crucially, under capitalism the purpose of increasing production is *not* primarily to meet human needs, but rather to extract and accumulate profit….

It's important to distinguish here between small businesses, which quite often operate with a steady-state, use-value logic (and which obviously preceded capitalism), and corporations whose main objective is expansion and accumulation… The result is a system that, left to itself, automatically generates inequality and ecological breakdown.

3. Finally, capitalism is notable for precluding democratic decision-making. Even in countries that prize political democracy, democratic principles are rarely allowed to operate in the sphere of production, where decisions are made overwhelmingly by those who control capital….

In sum, the tendency to equate capitalism with "markets and trade" naturalizes a system that is not natural, and prevents us from having a clear-eyed view of how it operates and how we might want to do things differently.

Source: Jason Hickel on X

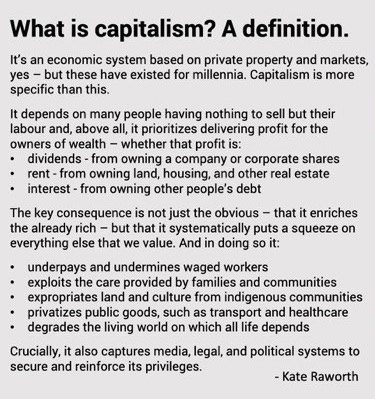

And here is a different, but similar definition by Kate Raworth (author of Doughnut Economics):

Why does it matter?

It is clear that there is more to capitalism than simply markets and trade. Because of this, there are some organisational types that are more geared towards the perpetuation of capitalism than others, namely those that are “driven by finance capital’s compulsive addiction to growth”. This includes publicly listed corporations, and those private corporations who are funded by capitalists looking for growth on their investment. It is these organisational and funding types that we should be focusing our energies on and trying to regulate, or even better, dismantle if we want to keep the planet habitable.

I’m sure we can all think of small businesses like the ones Hickel describes in the definition of capitalism above. Ones that grow to a certain size and then happily remain at that size, selling goods at ‘use-value’ (the value of a good or service based on its use, as opposed to the exchange value - what those goods or services can be exchanged for on the market). I can list many in my life, including my Friday morning fitness class that is run by a sole-trader, many of my children’s after school and weekend activities, including cricket, futsal and dance, art and gymnastics classes, my favourite thai restaurant, my local cafe that is run by a sole-trader and the plumber we used when we had a water leak last month.

Not coincidentally, these organisations are often set-up to meet the needs of people in the least capital intensive way possible, for example by utilising public parks, local ovals and leasing spaces within community owned-centres. These small businesses want to keep their costs low and tend to to prefer to retain full ownership and so they often do so by using existing spaces, requiring little to no external funding and avoiding the growth trap. They are often run by the owner/s who have natural limits on their time and a reluctance to delegate the day-to-day operations of the business, further limiting their ability to grow. These businesses can, and often do, put people and the planet ahead of profits and growth.

In contrast, publicly traded corporations and capitalist-funded private corporations tend to be managed and run by people who aren’t the owners and need to grow to provide increasing returns to their investors. This very often results in problematic behaviours including lobbying governments for lax regulations, investing in carbon intensive activities when they should be transitioning away from them, offshoring activities to countries with lower-environmental standards, offshoring activities to places with lower labour costs, employing greenwashing strategies to make it appear as though they are taking sustainability seriously when they are really just looking to continue growing their businesses, and innovating in order to grow profits rather than to meet human needs, to highlight just a few examples.

The term ‘capitalism’ doesn’t mean all businesses, nor does it simply mean the transaction of a good or service for money, or the allocation of capital within markets. It refers to a specific economic system that relies on enclosure of the commons and the creation of artificial scarcity of what were previously public goods, needs perpetual growth and is undemocratic in nature. In terms of numbers, this is a small proportion of all organisations that exist in the world today. Being clear on which organisations are perpetuating the harm to people and the planet allows us to both specifically develop strategies to reduce the power (or better yet, existence) of these organisations and ensure that we are specifically addressing the root cause of our ecological crises: infinite growth on our finite planet.

What we might do to reduce the power of these organisations needs to be determined democratically and may vary from country to country, but could include the following: a cap on the size of an organisation (in terms of number of employees, size of revenue/profit, or resources used), taxation of 100% on capital gains, dividends, rent, interest income, or corporate profit, the dissolution of these legal structures entirely, a profit non-distribution constraint so that profits can’t flow back to individuals at all, a requirement that owners must work in their organisation and a limit to how many organisations they can have shares in. I’m sure there are many more ideas out there for reining in the oversized power these capitalist structures hold, but one thing I know for sure is that this system has been constructed by humans and can be deconstructed by humans.

This is where we come in. We can all play a role in creating the change we want to see in the world, but I honestly believe it is unlikely to come from within the system (see my article titled “Corporations can’t be ‘greened’”), and it’s unlikely to come from ignoring the root cause of our crises, as tempting as it is to focus on the things we do want, rather than the things we don’t want. If we want to stop the destruction of the planet, we need to stop the things causing the destruction of the planet: corporations and their endless need for growth. That is where, in my opinion, our efforts are best placed.

Protecting the Future exists because of my paid supporters who see the importance of this work. If this project is of value to you, consider becoming a paid subscriber today.

In case you missed it, this week Jason Hickel wrote a blog about the popularity of post-growth policies: ‘How popular are post-growth and post-capitalist ideas? Some recent data’, and it is very encouraging! There is strong support from the general public for an economy that meets the needs of people and the planet, without further growth.

Last week I wrote about ending poverty, and the wonderful example of Kerala and Kudumbashree:

When I posted the article on LinkedIn I received lots of comments from people saying that we need economic growth to fund the anti-poverty policies. I didn’t address funding specifically in the article because Kerala isn’t a currency-issuing nation and so it does rely on remittances, taxes and funding from the federal government, however, at a national level (where ideally we would be ending poverty), this does not need to be the case, and currency-issuing nations can fund anything they like. This is how the monetary system works: all government spending is new money, all taxes are destroyed. I hope to one day write a piece on this, but for now, here are some further resources on this topic:

Stephanie Kelton The Deficit Myth

Stephanie Kelton The big myth of government deficits | TED (14 minutes)

Stephanie Kelton "But How Will We Pay for It? Making Public Money Work for Us" (51 minutes)

Jason Hickel: ‘Degrowth and MMT: A Thought Experiment’

Old, Schneider and Hickel: ‘How to pay for saving the world: Modern Monetary Theory for a degrowth transition’

Bill Mitchell’s Blog, which provides detailed analysis and commentary on economic events from a Modern Monetary Theory (MMT) perspective.

Hi Erin - a friend sent me the link to this post. I read it and glanced at your other work. Based on your interest, you may want to consider checking out Becoming Denizen, a group of people looking at these issues broadly. https://www.becomingdenizen.com/ You may also want to check out the work of Jem Bendell and his latest book. I reviewed it and discussed it and more in this essay. https://medium.com/@jylterps/what-then-could-we-do-reflections-on-confronting-moloch-a78018331e94

The natural anti-democratic aspect of capitalism that is a result of concentrated capital and concentrated governance has two consequences:

1. Accessibility: concentrated decisionmaking means faster decisionmaking, more focus, and more concentrated effort, which drives lower costs and higher productivity. Capitalism is touted for productive efficiency that makes output more accessible and raises standards of living. It fuels the egos of consumers.

2. Extraction: the greater efficiency in the value chain would be wonderful if it meant profit (whether financial or metaphorical) was spread among the people and planetary resources involved in production. But value is extracted by the capitalists, and growth comes from squeezing people and planet to just above their breaking point, or beyond; if a capitalist can extract value from something that society didn’t even think to charge for, they will be leaving society to pay for it, while they take the profit. Capitalism fuels the egos of investors.

Consumption and extraction are the two unsustainable attributes of capitalism. They’re the two we have to change if we want to save the world.